Mobile Invoices: Everything You Need to Know

To stay afloat in a sea of competition, adaptation is key. One area that’s seen a pretty big transformation in recent years is invoicing. Gone are the days of checks, paper invoices, and manual tracking. It’s time to say hello to the future of billing—mobile invoices.

This week, we’ll explore how mobile invoicing is changing the game and why it’s beneficial for local businesses like yours. Let’s take a closer look.

Easily send mobile invoices to customers via text or email

How Mobile Invoicing Benefits Local Businesses

Mobile invoicing is more than just a trend; it’s a powerful tool for streamlining your operations. Small business owners and clients alike are no longer tied to their desks—they’re on the move, and busy clients on the go greatly appreciate the convenience of paying for services with just a few taps of their smartphones. A great client payment experience means you keep your customers happy and get paid faster—a win-win!

Let’s get into the nitty-gritty of this process shift and understand why you should get on board.

A Closer Look at the Process and Advantages

Mobile invoicing simplifies what used to be a very cumbersome process. Today, you can utilize automation to create, send, and even manage invoices digitally through apps, emails, and mobile-friendly banking platforms. This flexibility translates into faster payments and happier clients.

What Are Mobile Invoices?

Before we dive into the benefits, let’s define what mobile invoicing is and why it matters. You might be surprised to discover that you are already using mobile invoicing in one way or another.

If you own an autobody shop, for example, that offers customers wifi while they wait, you likely receive invoices from your internet provider each month in an email. You might also have automatic payments set up for the funds to come out of your bank account directly. This is essentially the main idea behind mobile invoicing.

Mobile invoices are digital bills that can be generated and managed using a mobile device. Their importance lies in their ease of use and the seamless synchronization of data across devices. For a local business owner, that means you can spend more time focusing on your business and less time being tied to your office desk trying to get your finances in order.

Related topics for your specific industry:

- Best Invoicing Software for Construction

- Plumber Invoice Software

- Mobile Invoicing for HVAC Contractors

Benefits of Mobile Invoices

Now, let’s explore the real gems of mobile invoicing:

Send Invoices Anytime, Anywhere

You’re no longer bound by office hours, and neither are your customers. Create and send invoices from wherever you are, whether it’s halfway across the world or in between reps at the gym.

Get Paid Faster with Automation and Reminders

Automated reminders ensure your clients never miss a payment. These can take the form of text messages, push notifications, or friendly follow-up emails. These friendly nudges help keep your business top of mind and mean faster payments for you.

Boost Customer Satisfaction with Added Convenience

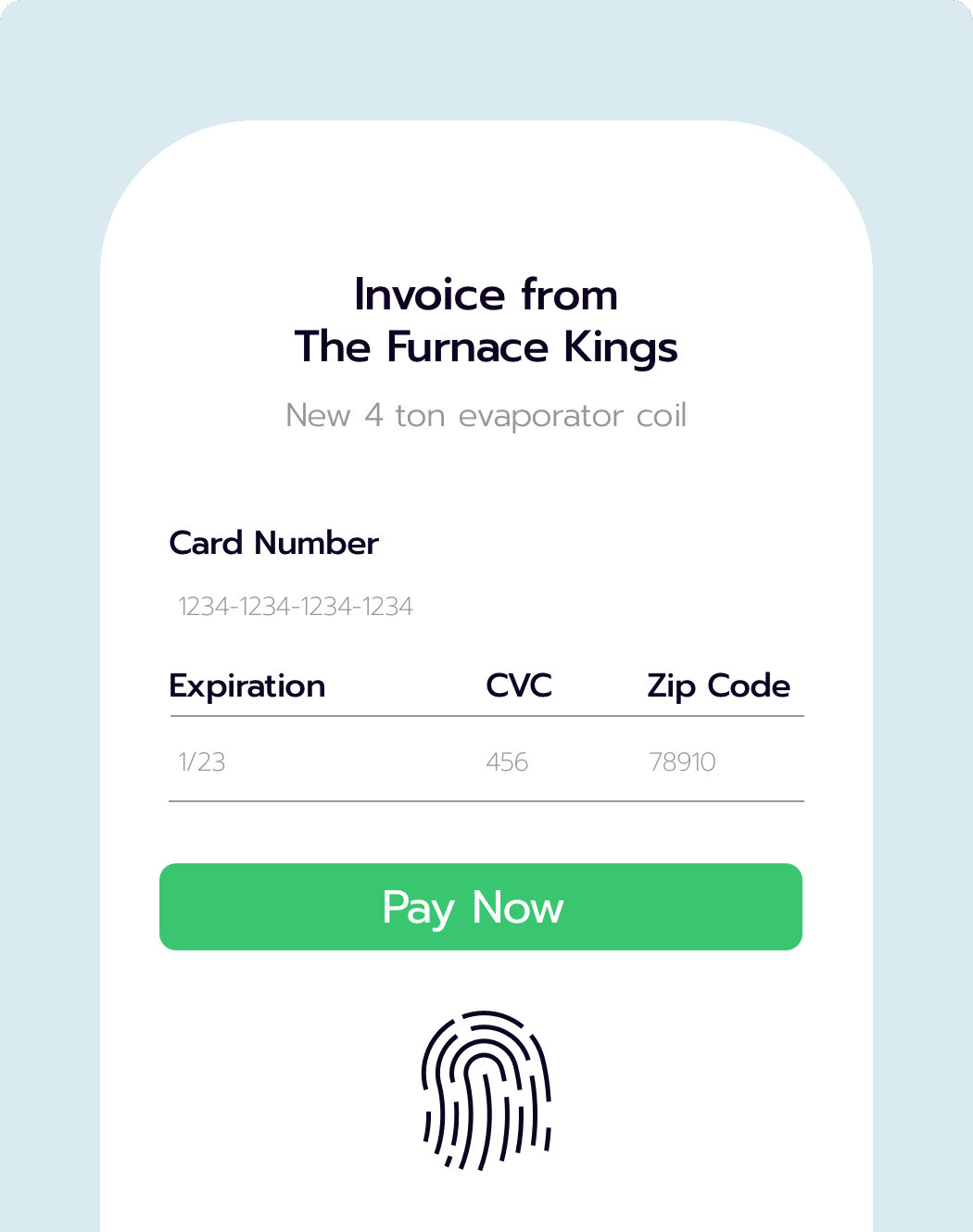

Your clients will love the ease of receiving invoices directly to their phones and the convenience of online payment synchronization with their bank or credit card. When you choose to invoice online, you showcase yourself as a tech-savvy business owner who values their clients’ time.

Access Financial Data on the Go

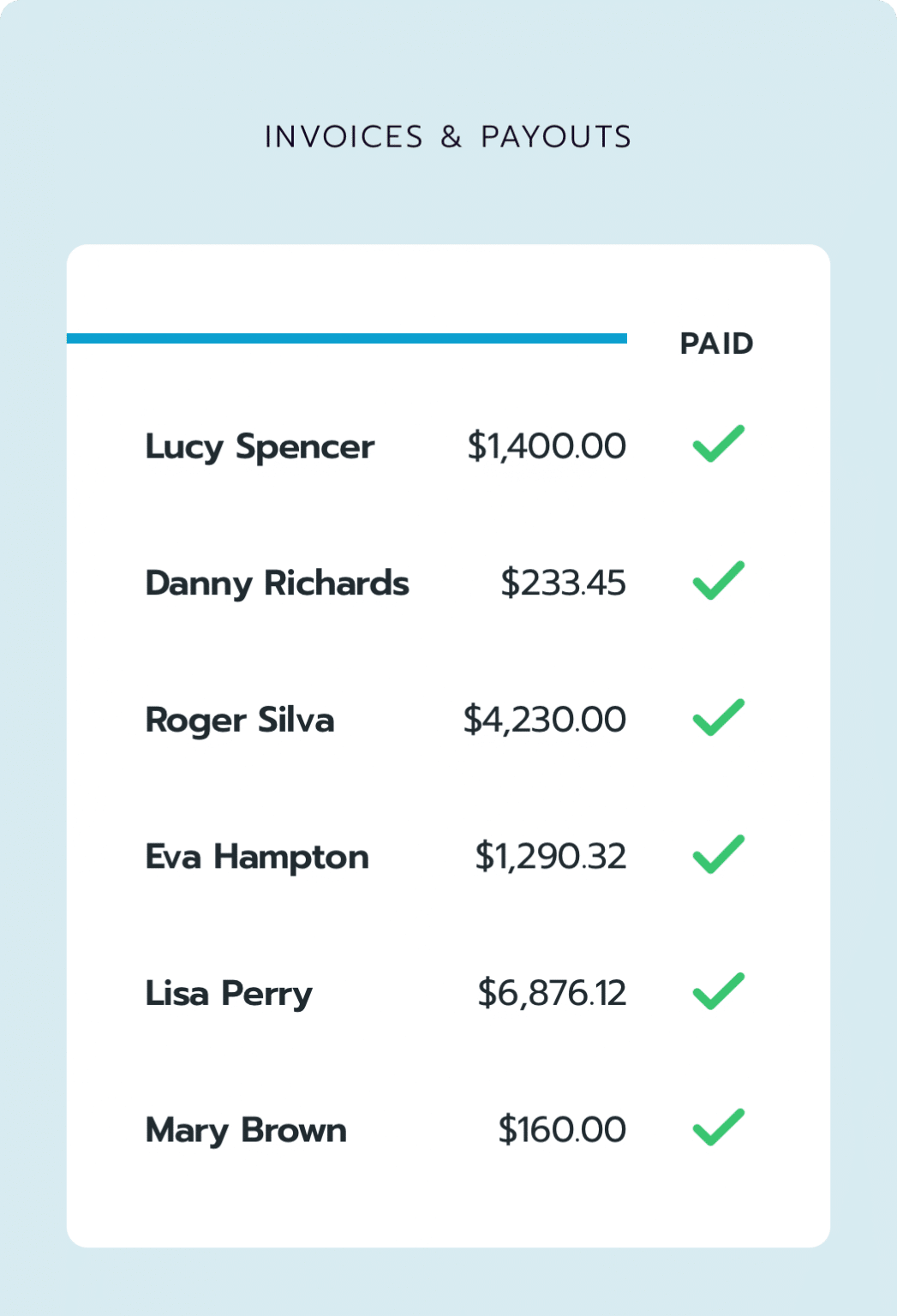

Mobile invoicing gives you the power to access your financial data whenever you need it. Stay in control, even on the go, to help you make real-time, informed decisions.

Enabling Business Growth with Additional Functionalities

Mobile invoicing tools often come with additional features like expense tracking, which can help you plan short and long-term goals as you grow your business.

Standardized Billing Processes for Consistency

Invoices generated automatically through a mobile invoicing system offer a level of consistency that’s hard to come by with manual input. Human errors, such as typos or mistakes in calculations, can occasionally slip into hand-prepared invoices. However, with automated invoicing, you significantly reduce this risk.

These systems can generate invoices with impeccable accuracy and a uniform, professional appearance, eliminating inconsistencies and solidifying trust with clients that they are getting what they paid for.

Easy Management and Sorting of Invoices

Digital invoices make it super easy to keep your billing information neat and tidy—no more dealing with stacks upon stacks of paper. Plus, your financial data is stored safely and securely in the cloud, so you don’t have to worry about stuff like water damage, mold, or fire impacting your financial records. Digital invoice management also makes it a breeze to find and manage your invoices whenever you need them, so you can spend less time sorting through paper files and more time growing your business.

Sending Automated Reminders for Unpaid Bills

We all know that sometimes things slip through the cracks, but with digital invoicing, you don’t have to worry about keeping track of who still owes you money. Automated reminders do the job for you, sending friendly reminders to your customers when their payment is overdue. It’s a hassle-free way to ensure you get paid without the awkward phone calls, and it helps keep your cash flow steady

Flexibility for Customers Without Credit Cards

Not everyone carries a credit card, and we get that. With digital invoicing, you can cater to a broader audience by offering multiple payment options. This means clients who prefer alternatives, like bank transfers or online payment services, can easily settle their bills without the red tape. With automatic invoicing, you can make life simpler for your clients and improve their overall experience with your business.

Accounting Integration

Managing your finances is a breeze with mobile invoicing, as it often integrates smoothly with well-known accounting software packages. This means you’ll spend less time on manual data entry and fussing with sales tax or currency conversions. By syncing your invoicing with accounting software, you can ensure your financial records are always up-to-date, accurate, and well-organized.

Safety Concerns in Mobile Invoicing

Embracing mobile invoicing is undoubtedly convenient, but it’s natural to have safety concerns. It’s important to address any concerns you and your team might have and understand that the rewards of mobile invoicing far outweigh the risks. When implemented correctly, mobile invoicing can provide safe and secure online transactions that protect both your business and your customers.

Businesses often prioritize the safety and security of financial transactions, and rightly so. With mobile invoicing, you can have peace of mind by following best practices and ensuring that your invoicing system is equipped with robust security measures. Protecting sensitive customer data is essential, and reputable mobile invoicing platforms are designed to do just that.

One key aspect of safe mobile invoicing is choosing a trusted and secure platform or application that uses encryption and other security features. This ensures that sensitive financial information remains confidential and inaccessible to unauthorized individuals.

Additionally, educating yourself and your team about the best security practices when handling mobile invoicing can further mitigate potential risks:

- Regularly update your mobile invoicing software.

- Use strong passwords.

- Consider two-factor authentication for added security layers.

By incorporating these practices, you’ll make your mobile invoicing process safe and reliable for both your business and your clients.

Why Mobile Invoices Matter

Mobile invoicing isn’t just a fancy add-on; it’s a vital tool for business owners who want to simplify their operations, get paid faster, and keep their clients satisfied. It’s a mutually beneficial situation for both parties.

Embracing the Power of Mobile Invoicing

The days of struggling with paper invoices and manual tracking are behind us, and it is safe to say that mobile invoicing is the way of the future for local businesses. It streamlines your operations, making everything more efficient, accurate, and convenient.

If you’re considering making the transition to mobile invoicing, here are some simple steps to help you get started:

1. Choose the Right Mobile Invoicing Software

Research and select a mobile invoicing application or software that suits your business needs. Look for user-friendly options that offer features such as easy invoice creation, payment processing, and client management.

2. Create Professional Invoice Templates

Design professional and branded invoice templates that reflect your business identity. These templates can be customized with your logo and contact information, providing a consistent and polished look for your invoices.

3. Gather Customer Information

Input your clients’ contact details into the mobile invoicing software for quick and easy access. Ensure that you have their correct email addresses, which will be crucial for sending invoices electronically.

4. Practice Invoicing

Begin by creating and sending a few invoices to familiarize yourself with the process. Many mobile invoicing tools offer sample invoices or templates to help you get started. These initial invoices can be sent to yourself or trusted colleagues for practice.

5. Learn About Payment Processing

Understand the payment processing options available in your chosen mobile invoicing software. Most platforms allow you to receive payments electronically, so explore the setup for credit card or online payment processing.

6. Customize Payment Terms

Define clear payment terms, including due dates and late fees, to ensure your clients understand the expectations. This step is essential for smooth transactions and preventing payment delays.

7. Organize and Archive Invoices

Implement a systematic approach to organize and archive your invoices. Proper record-keeping will help you stay on top of your finances and make tax season much less of a headache.

8. Educate Your Team

If you have employees or team members assisting with invoicing, ensure they are trained on the mobile invoicing system. This will help maintain consistency and efficiency across your business operations.

By following these steps, you can make a smooth transition to mobile invoicing, harnessing its benefits to streamline your invoicing process and improve the overall efficiency of your business operations.

Start Using Mobile Invoices with Broadly Payments

Want to harness the full power of mobile invoicing? Say goodbye to manual invoicing and hello to the future with Broadly’s mobile payments system! See what Broadly can do for your business in just 30 days. Schedule a demo with us today!

Transform your local business with revolutionary AI-powered software